Needs and desires are the foundation of sales

If we want to sell a lot of anything, we should be thinking about what people buy a lot of. The fundamental reason they buy a lot of anything is because they either need a lot of it, or they at least want a lot of it. And what would be the most reliable source of information about shoppers' needs and wants? Simply put, it is in the record of their purchases, ideally as revealed in the transaction logs, so we can see how many people buy, how much they individually purchase, what else they purchase, etc.

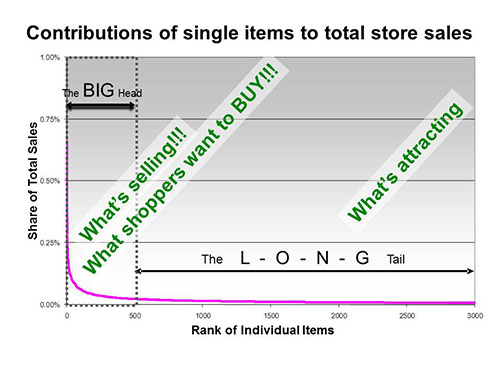

Past issues of the Views have drawn a consistent distinction between big head and long tail marketing. The big head is of course those (relatively) few items that contribute a large proportion of sales; while the long tail is the many which contribute minor to negligible sales, individually. In general, the big head represents the greatest opportunity for accelerating sales and profits, simply because the big head expresses, massively, the in-most desires and needs of the crowd of shoppers. In general, focusing on the largest impact items is equivalent to focusing on the most productive sales, leveraging some approximation of the Pareto Principle.

In this issue of the Views we will consider in greater detail, the rational role of the long tail and SKU proliferation, in relation to the big head; as well as tools (other than simple economics) to limit long tail growth. Our excursion here into the structure of the long tail should not detract from a focus on the big head, and with the next issue of the Views, we will get much more specific about exactly how to sell the big head in the presence of the long tail.

We have described before the proper role of the long tail, first in terms of attracting shoppers (not selling to them,) but also to the competitive imperative: for a supplier, the shelf space you do not occupy, your competitors will. Of course the long tail does generate some sales directly, but it also controls some big head purchases.

Any shopper who avoids a store because they do not carry that shopper's possibly desired single long tail item, will forgo all of that shopper's purchases, including their big head purchases. This is the foundation of my insistence that from the shopper's point of view, there is no limit to the size of the ideal long tail. I myself buy a few books a month, mostly from Amazon, primarily because I figure that anyone with 50 million books will probably have the one I want. : )

The "best" vs. the ideal or

Growing the long tail from the big head

When we note that "the big head expresses... the in-most desires and needs of the crowd of shoppers," it means that if shoppers buy ten times more of item A than of item K, it is because they, as a crowd, likely have ten times more need or desire for A than for K. But does this mean that A is the ideal product? Not necessarily. The reality is that we are quite right to translate the sales curve into an expression of shoppers' needs and desires, in the aggregate. But this aggregate reaction to the properties of item A does not necessarily mean that item A has the most ideal set of properties.

Consider, for example, the sensory properties of item A, such things as sweetness, tartness, texture, color, etc. We know that from a sensory point of view, often there is no single ideal, for example, for texture. When it comes to texture, there are two broad groups of people: those who prefer crisper, harder textures, and those who prefer softer, smoother textures. In this case, if you produce a single product with a texture that comes closest to meeting the "average" need of the aggregate crowd, you will please no one as well as you could. The reality is that the response curve of texture exhibits two peaks — a bimodal distribution. As a consequence we have thin crust pizza, and thick crust pizza; extra crispy chicken, and original chicken; smooth and creamy peanut butter, and chunky peanut butter; etc.

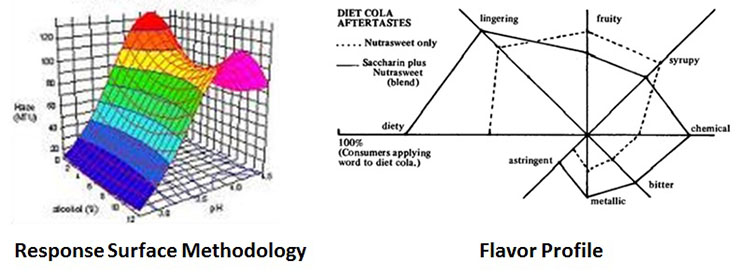

This simple texture example illustrates why there may be NO single "best" product to address the needs of the whole crowd. The ideal, at least for texture, is often to have two "best" products, one for those tending to favor soft, and another for those tending to favor crisp. Here we are only considering one dimension of texture, to say nothing of multi-modes that occur with flavors, sweetness and dozens of other product attributes. Sensory scientists use analysis like Response Surface Methodology (RSM) to map sensory properties of foods, and to guide directions for product development.

The multi-dimensional sensory surface can look more like a mountain range, than just a few peaks. From those peaks, a plan for proliferating product options (SKUs) can emerge. Obviously, the more "peak" products produced, the greater the probability that every possible shopper need or want will be addressed.

To more sharply focus on specific product attributes like flavor, the "flavor profile" is ordinarily created by a small panel of trained-harmonized judges. In the diet cola aftertaste example above, the method was adapted for use with a large consumer panel, where the meaning of the descriptive words is not "trained" into the judge-respondents, but it is simply the meaning as hundreds of consumers might collectively use them.

RSM and flavor profiling are valuable tools to support proliferation of products to assure that not just a single "best," optimized for the mass is offered, but that other significant segments with tastes differing from those of the crowd, are also well served. We can see this proliferation as a "growing of the long tail from the big head."

How many "bests" should we offer shoppers?

We are mentioning these techniques, because there is a certain rationality to the multitude of options (SKUs) found in the warehouses of any major city. Typically, a retailer who stocks tens of thousands of items in their stores, has selected from a million or more items available in area warehouses. That selection process is obviously driven by competitive issues, including the brand-on-brand gladiatorial contest. However, upper most in the retailer's mind is that some share of shoppers may not be "reached" with whatever limitation in selection is provided.

Whether done formally or not, shrinking the range offering to the minimum necessary to meet the needs and desires of all the shoppers is the subject of TURF analysis, Total Unduplicated Reach and Frequency, one technique to guide SKU rationalization (SKU-rat.) TURF is adapted from media planning tools, where the media planner wants to reach an audience across a variety of media, and wants each additional media buy to reach as many new people as possible; not simply duplicate the reach already achieved by other media. The parallel for a product line with multiple flavors or varieties is, for each additional flavor to bring new shoppers, or new sales to the line, not simply to shuffle existing sales into new varieties. Just as RSM can drive proliferation, TURF can restrain it.

The mustard/ketchup marketing conundrum

For a real world study of success with proliferation, and some limitations, consider the mustard/ketchup marketing conundrum. Up until a few years ago, French's yellow mustard dominated the American market. Then, after Heublein discovered the potential for conversion of mustard users from French's to Grey Poupon, not only did conversion and proliferation of mustard SKUs get underway in a major way, but the market (at nearly three times the price per ounce) exploded. Today most supermarkets have an entire section devoted to varieties of mustards.

Subsequent attempts by others to repeat this astounding mustard proliferation success, with ketchup, remain struggling efforts. Why could mustard proliferate varieties/brands and ketchup could not (so far?) Malcolm Gladwell has discussed this in detail in his essay on "The Ketchup Conundrum." But mustard is by no means the only example of explosive growth through SKU proliferation. Decades ago yogurt with its multitudinous flavors became a mainstream major category in dairy, whereas before it had been a fringe product much favored in "health food" stores. Something like this happened with the mainstreaming of salsa as well, and pasta varieties have grown healthily - although the US market still lags Europe significantly for the category. Of course "ketchup" began in China as a sauce made of pickled fish and spices, and the current tomato ketchup, or catsup, is a far removed relative of some of its great great grandparents. Perhaps barbecue sauces and salsa do represent more ketchup proliferation than might be readily apparent. Could the growth of ranch dressing as a condiment be further "ketchup" proliferation?

The vast majority of proliferations show no signs of reproducing the successes of mustard or yogurt, but simply provides more clutter for the shopper, virtually burying the big head in the long tail, and thereby suppressing sales of those big head items which express, massively, "the in-most desires and needs of the crowd of shoppers." So we answer the question of, "How many 'bests' should we actively sell to shoppers?"... with, very few. That "very few" answer is partially driven by the practicalities of how we can possibly sell anything, rather than simply dumping it before shoppers and hope they buy it — classic "order taking," NOT "selling."

Summary Principles

The main points we have emphasized:

- The big head expresses, massively, the in-most desires and needs of the crowd of shoppers.

- From the shopper's point of view, there is no limit to the size of the ideal long tail - the longer, the more attractive.

- For a supplier, the shelf space you do not occupy, your competitors will.

- The long tail controls some big head purchases: if the shopper avoids a store because of a missing SKU, they will forgo big head purchases there, too.

- The long tail grows from the big head as the interests of the "few" shoppers diverge from the interests of the "many."

- Just as Response Surface Methodology (RSM) can drive proliferation, Total Unduplicated Reach and Frequency (TURF) can restrain it.

The reality is that big head items get inadequate focus and selling to shoppers. Many of them would receive double digit, if not triple digit increases, IF THE INDIVIDUAL ITEMS WERE PROPERLY SOLD!!! The impact on total sales of the brand, the total category, and the total store would compound out of all proportion to the few items focused on.

In the next issue of the Views I will explain in some detail how to use "personal selling" techniques, in the self-service store, to actually sell the few, in the presence of the many. Focus will be the watchword. : )

Here's to GREAT "Shopping!"