As with so much in "shopping," what seems simple and obvious on the surface is not nearly so simple in reality. This has led to a great deal of superficiality in dealing with the subject. But that superficiality is not always amiss, since sometimes capturing one aspect of a matter is adequate to the purpose. I'm offering here three simple ways to look at the quick trip, and then a fourth that gets closer to reality, but is less useful for day-to-day practice.

The quick trip takes little time . . .

Focussing on the "quick" part suggests that time is the crucial element of the quick trip. But there are two major problems with using time for this purpose. The first is that actually measuring the time of a shopping trip, as important as that is, (see The Three Shopping Currencies,) is not easily or commonly done - other than in our PathTracker® methodology. Instead, it is easier to rely on shoppers' own perceptions of the time they spend on shopping trips by asking them. Clearly this is easy, but introduces a massive dose of subjectivism and/or measurement error into the quick trip.

The second problem with this approach is that, for example, a "quick trip" to a supermarket, to a drug store, or to a supercenter, might reasonably be expected to have different time durations. The reality is that using time to define a quick trip makes a lot of intuitive sense, but practically it gets very complicated.

The quick trip buys only a small amount of merchandise . . .

Like time, this approach seems eminently reasonable, and it does have the advantage that counting items is less subjective, and is done automatically by the electronic scanner at checkout. This last fact means that, theoretically, there are truckloads of data on this type of quick trip, buried in the transaction logs (T-logs) of the stores.

Have you ever seen any of this data? No? Although we spend lots of time looking at T-log data, I have yet to meet an organization that focuses on the properties of shopping trips based on T-logs. OK, challenge me on this. If more people were looking at actual individual data in the store, it would be more widely known that one is the single most common number of items purchased in any store in the world, regardless of class of trade or channel - whether convenience store, drug store, supermarket, supercenter or other - it makes no difference. ONE is the most frequent trasaction size in them all!

Having said this, the median of basket sizes, (half are larger, half are smaller,) varies significantly. In drug stores, the median is more likely 3 items, while in supermarkets it is more likely 5 items. This complicates things significantly if you are simply trying to define the quick trip by the number of items purchased.

Trying to come up with a reasonable definition of the quick trip by using some blend of time and items is seriously fraught. This is illustrated in an earlier Views, "Average" Quicksand.

The quick trip buys certain types of merchandise . . .

Other than general learning, the practical purpose of trying to understand the quick trip is to figure out how to accommodate the shopper most efficiently, sell them the most, when they are on a quick trip. This requires knowing what they may buy on a quick trip. So perhaps we could create a list of items that shoppers buy on a quick trip, and use that to define the trip? In his chapter, The Quick Trip Paradox in my book coming out in the next couple of months, Mike Twitty of Unilever addresses this exact possibility, and finds that there is no common list that characterizes the quick trip. From the shopper's point of view, the quick trip is characterized by immediacy, something they either need right now, like batteries, shaving cream or an ingredient; or something they are going to consume right now, like a beverage, a snack or some other small pleasure.

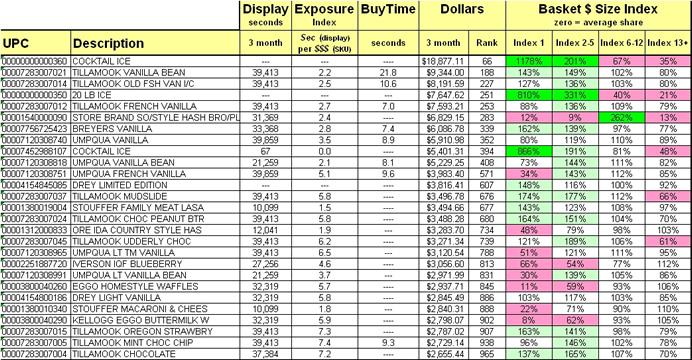

Given the tremendous importance of the quick trip (half or more of all shopping trips - by any definition,) we have found it useful to index every item in the store by the likelihood that it will be in a small basket. But we also consider the BuyTime for the items (how many seconds it takes a purchaser to select the item, once they are within reach of it,) as well as how many seconds the product is exposed to shoppers in front of that display. In this way we are incorporating all three of the quick trip measures, time, number of items and exact merchandise as tools in managing quick trips.

Here is a table showing the interaction of a number of these measures for all of the frozen items in this store, that rank within the top 1000 items the store sells. This table will vary from store to store, but there are obvious patterns across stores.

Under the "Dollars - Rank" column you can see how important this single item is to total store sales - where every single item in the store is ranked from 1 - 34,000. On the left side you can see the number of "shopper seconds" that the display where the item is located gets in the 3 month period. This time is indexed for "Exposures," compared to the amount of dollars of revenue the item is receiving. As you go down the list, that index tends to increase, because, with the same exposures as other items on the shelf, the lower the sales, the more exposure is being given per dollar. The significance of this is that Stouffer Meat Lasagna and Stouffer Macaroni and Cheese, and Ore-ida Frozen Hashbrowns are getting very little exposure for the significant amount of sales they are generating, which means there is probably a lot of potential for getting more sales by giving them more exposure - higher traffic areas.

BuyTime is the number of seconds it takes a shopper, on average, to buy the product. Notice that the vanilla bean ice cream is selling a lot, but taking a lot of time to do it - about twice as long as the old fashioned vanilla right below it in the table. This failure to close quickly argues against giving the product more exposure until what is holding back the shopper is determined and fixed. Just as a guess, it could be inclusion of the word "bean" in the name, that is giving shoppers pause, slowing their decision. Not shown in this table are the affinities for each of these items, that is, the top 3 companion products bought with the item. The richness of individual item purchases, properly managed, can lead to enriched sales!

On the right you see indices based on how likely this specific item is to appear in a basket of this size, the first two columns approximating quick trips and the last column approximating the stock-up trip. Notice that of the three items mentioned above, only the Stouffer Meat Lasagna indexes highly for the quick trip, single item purchase, while the other two index more highly for the stock-up trip. (In order to spot these trends more readily, light green is used to emphasize those items that are more than 30% more likely to occur on that class of trip, and brighter green for those 100% more likely - 2X. The pinks are less likely to be in the stated column.) Ice of any type is the most likely frozen item to be purchased on a quick trip.

A Fourth View of the Quick Trip . . .

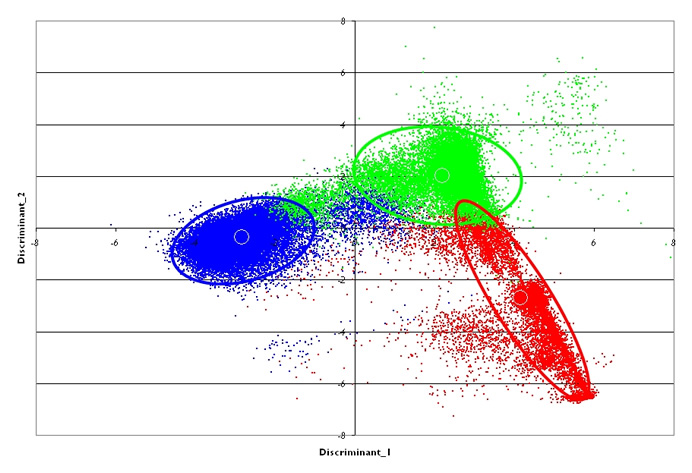

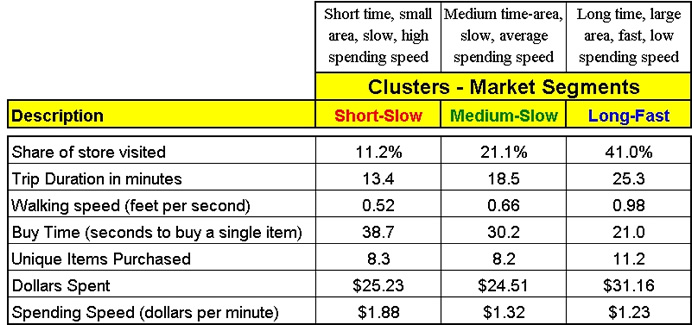

Some years ago we looked at letting shoppers group themselves by their behavior in the store, rather than by us calling out some characteristic, or certainly not asking them. It is always more reliable to see what shoppers do than to ask them what they do. The first is a matter of measurement and is scientifically accurate. The second is filtered through both the shoppers' perceptions, as well as the researchers acumen. For our study we took a substantial variety of measures for individual shoppers, including things like the total seconds in their trip, how fast they walked, what percentage of the store they visited, which areas of the store they visited, and a number of other metrics. Then 75,000 shoppers across three stores were subjected to hierarchical cluster analysis, with these results:

There is a dot here for each of the 75,000 shoppers. Even without color coding it is clear that these shoppers are "clustered" according to their behavior. But it is a complex interaction, and here is a summary description of each of the segments:

Walking speed is a significant discriminant among the shoppers, with "quick trippers" walking more slowly and "stock-ups" walking faster. This counter-intuitive finding is a direct consequence of the fact that quick trippers spend most of their short time in the store purchasing merchandise (standing in front of displays) while the stock-up shopper spends an inordinate amount of time cruising around the store - walking a lot faster on average.

One of the reasons for presenting this material here on the quick trip (behavioral segmentation) is because it is counter-intuitive, but at the same time confirms the general idea of the quick trip. This segmentation work was a preliminary look, which could now be significantly enhanced with our greater database of stores, shoppers and data. But, meanwhile, we proceed with a melange of the "simple" metrics: time, items and merchandise.